FMCIC Church-Building Financing Programs

(Updated March 2023)

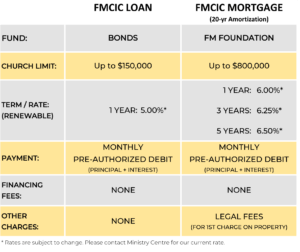

The FMCIC has two programs which can help fund your church renovation, repair or build:

- The Loan Program and

- The Mortgage Program.

Because all church properties are classified as commercial, they do not qualify for residential rates on loans or mortgages.

The Management Committee bases the interest rates charged on current commercial/Bank of Canada rates. Both programs (Loan + Mortgage) offer a renewable, open financing option for churches which can be amortized up to 20 years. Unlike most financial institutions, there are no setup fees or penalties for early repayment.

Where the Money Comes From….

“Right now you have plenty and can help them; then at some other time they can share with you when you need it.

In this way, each will have as much as he needs… So you also should share with those in need.”

2 Corinthians 8:14b-15 TBLThe FMCIC Loan Program is funded primarily by FMCIC Bonds – As a church or individual with excess funds, you can help other churches in need by investing in FMCIC Bonds. Your investment in our churches will bring not only an eternal return, but a current interest rate of 2% which is paid out June 1st and December 1st of each year. Please contact Roseline Isaac in the Administrative Services Department at 905-848-2600 ext. 210 for further information.

The Mortgage Program is funded by the Free Methodist Foundation (FMF). The interest charged is used to support the various ministries supported by the FMF, which include special scholarships, church planting, missions and the supplementary financial support for the CORE operating budget with the FMCIC.

Church Loan/Mortgage Financing Checklist:

- Letter to FMCiC explaining:

- The Proposed Plan

- How much is expected to be funded with donations/cash on hand

- How much is expected to be needed from debt financing

- That firm quotations are in place to perform the work

- Last 2 years of Audited Financial Statements

- Current Year-to-Date Financial Statements

- Board of Administration (BOA) Management Committee Approval for Loan; FMF Director approval for Mortgage (Please allow two (2) weeks for review/approval)

- FMF Legal Counsel to arrange 1st charge to be placed on the property in consultation with local church legal counsel (Mortgage Program only)

- Pre-authorized debit payments arranged for monthly principle + interest payments on debt

(generally on the 22nd of each month)

What we will consider:

- Your church’s ability to repay the loan/mortgage

- We are called to wisely steward all the available resources entrusted to us by God and our local churches

- We have a responsibility to investors to properly steward these resources and to ensure that there is a reasonable expectation for repayment

- We do not want to burden the church with a loan/mortgage that they cannot afford – we are not helping here if we do

- Your church’s giving record to CORE

- The heart of CORE is connectional – we are called and expect churches to be

actively involved and supportive of each other - CORE is our movement’s collective support of ministries to help carry out the

vision to see a healthy church within the reach of all people in Canada and beyond. - Using the model of the Biblical tithe to support the greater ‘family’,

CORE is based on giving 10% of the total donations/receipts to the local church

less bequests, designated giving (missions, short-term projects, etc.) and special

offerings taken for outside the church (i.e. World Relief and other charitable organizations ¶440.2.2

- The heart of CORE is connectional – we are called and expect churches to be

THINGS TO REMEMBER ABOUT

CHURCH PROPERTY OWNERSHIP

When it comes to a local church building, it is hard for most members not to assume ‘ownership’ of the property. Especially when they and/or their family have sacrificed to give towards it. It is understandable that some would have difficulty with the requirement that all church property be titled or adhere to the Incorporation Association Agreement (if incorporated) to The Free Methodist Church in Canada or that any mortgage or sale of church property must be approved by the Management Committee of the general conference (the denomination).

There are both legal and theological reasons behind this:

- The key theological principle of all stewardship: It does not belong to us. This includes our church buildings. Everything we have, and even our ability to generously give, is because God has provided. We must hold all things lightly, as only being entrusted to us but always belonging to Him.

- The legal definition of a gift is a voluntary transfer of property without valuable consideration to the donor.

As a charity, all donations towards the building of a church must be done willingly and without any expectation of ‘ownership’. The building of any church belongs to the charity – not to the members that built it. Otherwise, it becomes a private members club and loses any tax exemption status.

The Manual provides instruction and direction on the use, mortgage, lease and sale of church properties:

- Consent of both the Society and the Management Committee of the FMCIC must be given prior to the mortgage, lease or sale of any property ¶350.1.2

- The church or parsonage property shall not be sold, mortgaged or encumbered for current expenses ¶350.1.3

- However, if real property is sold, and with the permission of the Management Committee of the FMCIC, the proceeds of the sale may be invested and the interest may be used to pay operating expenses. ¶350.2.3

- Title for all church property deeds must be in order in accordance with civil law and the trust clause in Paragraph 385 is included in all deeds. ¶ 350.1.1.1

- Facilities of Free Methodist churches are to be rented or used only by individuals or groups that are not incompatible with the goals, values, policies and statements of The Free Methodist Church in Canada and for purposes which are not incompatible with the goals, values, policies and statements of The Free Methodist Church in Canada. ¶630.3.1.10

- Whenever a local society ceases to exist, all real and personal property of the society must be sold and/or transferred to the conference. The proceeds may be used as directed by the conference board of administration, provided that they are first applied to clearing any remaining debts of the former society. ¶350.3